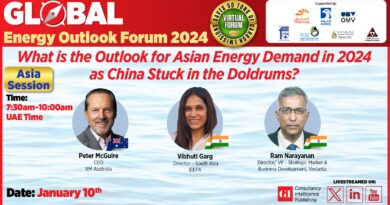

Global Energy Outlook Forum 2024

In this turbulent world, oil and commodity prices sure have shown different and divergent behaviours.

Shared my views on the Gulf Insights Intelligence energy markets session in a panel of esteemed speakers - Janiv Shah and Rob Barnett and moderated brilliantly as usual by Dyala Sabbagh.

Key points underscored:

1) Oil markets haven't been roiled up after the latest Israel- Iran skirmish as already a sizeable premium ~$15/bbl has been built in off late.

2) USA is working on all players to ensure that a full blown war doesn't occur as higher oil prices, in the event, will be disastrous in an election year.

3) China positive momentum will need to stand a test in Q2 2024 to conclude a positive recovery.

3) Indian growth story is steady despite elections.

4) India will continue to import Russian oil as long as discounts are offered.

5) OPEC will have to play a situation by situation game in this volatile geopolitical scenario.

Key points underscored:

1) Oil markets haven't been roiled up after the latest Israel- Iran skirmish as already a sizeable premium ~$15/bbl has been built in off late.

2) USA is working on all players to ensure that a full blown war doesn't occur as higher oil prices, in the event, will be disastrous in an election year.

3) China positive momentum will need to stand a test in Q2 2024 to conclude a positive recovery.

3) Indian growth story is steady despite elections.

4) India will continue to import Russian oil as long as discounts are offered.

5) OPEC will have to play a situation by situation game in this volatile geopolitical scenario.