Europe’s Energy Crossroads

Balancing Sustainability with Economic Realities

Europe’s ambitious energy transition is under strain. A decade of strong policy momentum toward renewables and decarbonization is now colliding with geopolitical shocks, industrial decline, and a recalibration of global financial flows. The question today is not whether Europe should pursue sustainability—but how it can do so without compromising economic resilience.

Industrial Retreat and the Energy Cost Burden

In early 2025, INEOS announced the closure of the Grangemouth refinery in Scotland—once the UK's last operational oil refinery. The company cited sustained economic unviability in the face of competition from more efficient, lower-cost refineries in Asia. Chairman Jim Ratcliffe pointed directly at the UK’s carbon pricing regime, stating, *“Carbon taxes are killing manufacturing in the UK.”*¹

This is not an isolated case. British Steel, the last remaining steelmaking entity in the UK, narrowly avoided closure thanks to direct state intervention. Across Europe, manufacturers face a squeeze from two sides: persistently high energy costs—exacerbated by the ongoing Russia-Ukraine conflict—and a softening in domestic and global demand.

This is not an isolated case. British Steel, the last remaining steelmaking entity in the UK, narrowly avoided closure thanks to direct state intervention. Across Europe, manufacturers face a squeeze from two sides: persistently high energy costs—exacerbated by the ongoing Russia-Ukraine conflict—and a softening in domestic and global demand.

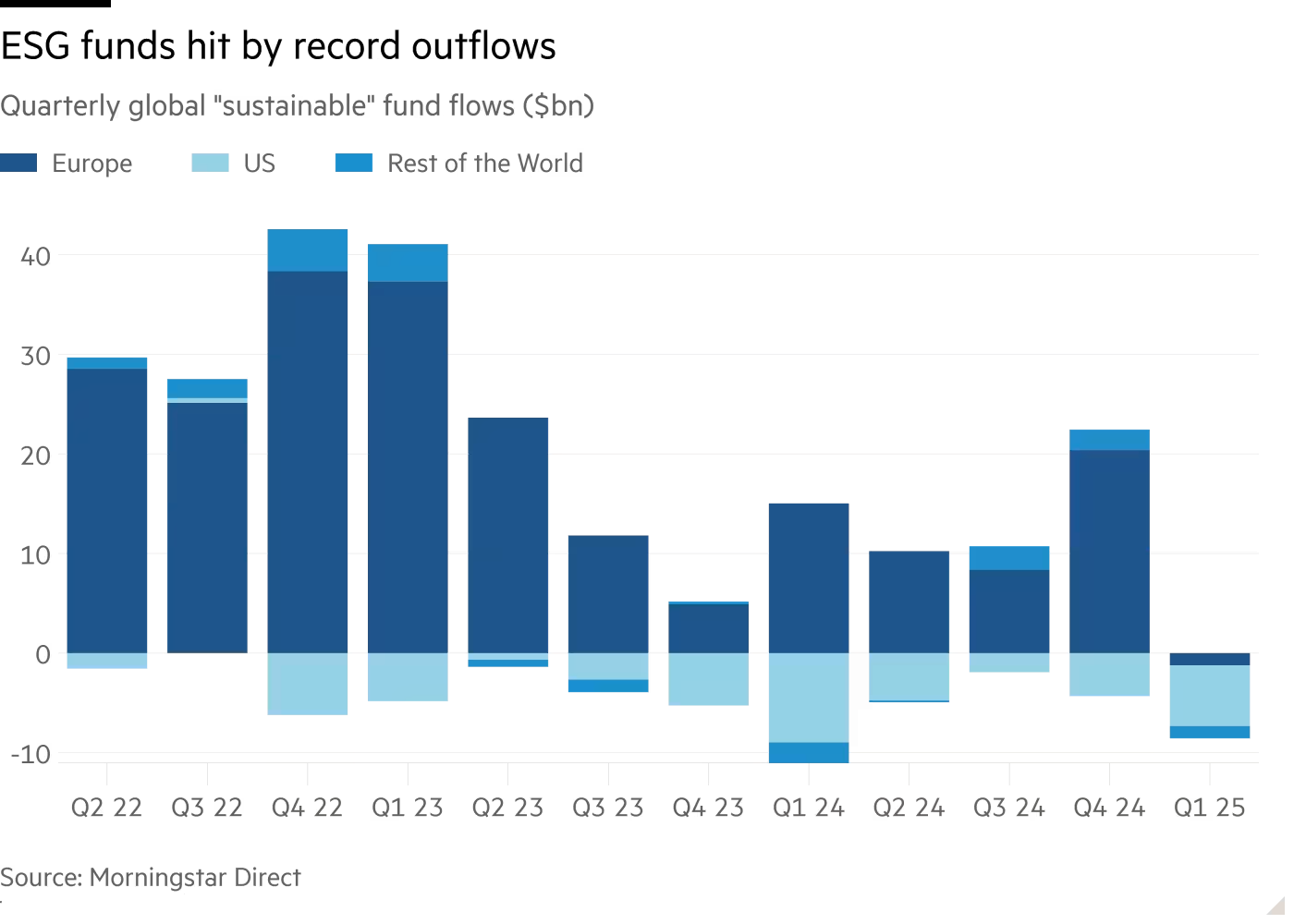

ESG Fatigue and Capital Flight

For the first time in three years, Europe witnessed net outflows from ESG-focused investment funds, with approximately $8.5 billion withdrawn in Q1 2025.² While the U.S. has seen ESG divestment since 2022—intensified by a policy pivot back toward fossil fuels—the trend now appears to be spilling into Europe. The high valuations once commanded by ESG-heavy portfolios are beginning to fade, dampened by investor scepticism about performance and regulatory overreach.

Grid Instability and the Limits of Intermittency

Recent blackouts in Spain and Portugal highlighted an often-overlooked vulnerability: over-reliance on intermittent renewable energy sources. High wind and solar penetration, without sufficient grid stabilization technologies (such as large-scale storage or demand-side management), risks destabilizing critical infrastructure. While renewables remain central to Europe’s long-term vision, the events underscore the need for a diversified and robust energy mix in the near term.

The Renewable Surge—and Its Backlash

Europe has led the global transition to renewable energy. Between 2016 and 2024, the continent increased its renewables share from 29% to 45%, while reducing fossil fuel reliance from 49% to 31%.³ Globally, renewables grew more modestly—from 23% to 31% over the same period. However, the pace of change may have been too rapid for critical infrastructure and industrial competitiveness to adjust.

The result: chronic underinvestment in conventional energy sources, exposure to geopolitical shocks ,most notably Russian gas disruptions, and a growing reliance on imported energy intermediates such as liquefied natural gas (LNG).

The result: chronic underinvestment in conventional energy sources, exposure to geopolitical shocks ,most notably Russian gas disruptions, and a growing reliance on imported energy intermediates such as liquefied natural gas (LNG).

What’s Next for European Energy Policy?

Germany increased coal-fired power generation by 16% in Q1 2025, partly offsetting declining wind output.⁴

The EU’s overall renewables share declined to 42%, down from nearly 50% in 2024, reflecting both seasonal factors and reliability concerns.

Europe is fast-tracking LNG infrastructure, with multiple new import terminals across Germany, Italy, and the Netherlands. LNG offers a cleaner bridge fuel with a lower carbon footprint than coal or oil, and enhances energy security by diversifying supply sources.

For A Pragmatic Path Forward

1

1

Phase the Transition Thoughtfully

Europe’s renewable shift must be guided by system reliability and industrial competitiveness. Overemphasis on speed over stability risks economic blowback. A diversified mix—including LNG, advanced nuclear, and transitional fossil fuel use—can provide stability while scaling low-carbon technologies.

2

2

Recalibrate Carbon Pricing

While carbon pricing remains a powerful tool to drive emissions reductions, its design must account for competitiveness impacts. A tiered or sector-specific approach may help protect vital industries without compromising environmental goals.

3

3

Reassess carbon focussed trade Mechanisms like CBAM

Carbon Border Adjustment Mechanism (CBAM)—meant to level the playing field on carbon-intensive imports—must evolve in light of global trade fragmentation. With countries like India still reliant on fossil fuels (≈70% of energy mix), rigid enforcement risks escalating costs for European manufacturers dependent on critical imports like steel and aluminum.

4

4

Reassess carbon focussed trade Mechanisms like CBAM

Europe must rebuild the confidence of its manufacturing sector through a combination of targeted energy subsidies, infrastructure upgrades, and innovation incentives—especially in cleantech, carbon capture, and storage solutions.

A New Phase of Realism

Europe is not abandoning sustainability—but entering a more pragmatic phase of its energy transition. One where economic resilience and technological maturity must co-exist with climate goals. Policymakers and industry leaders must now collaborate to recalibrate the path to net zero—balancing ambition with realism. The objective remains clear: a sustainable, secure, and economically viable energy future.

There is no cash in EU Petchems nor in the EU governments to realise GHG reduction agenda. Liquid LNG imports 3 times the price versus Russian NG kill energy intensive businesses ( good for US, Middle East who sell LNG and India& China who are not bound by those standards) The EU is lead by dreamers not under built by financials. The so called green deal reflects that.

Russian LNG now comes to EU indirectly 3 times price before and the EU government thinks these sanctions work. It is bad for EU and Russia, but great for US and Middle East. Whole the energy intensive industry destroyed and they are still telling nonsense to the public with their green deal. Now they suddenly want to spent big money on defence because of Russian threath. What nonsense. Only good for US defense industry

I predicted the collapse of Petchems in EU with these sanctions to Russia 3 years ago since they need cheap energy to compete. Same crazy stuff as these Trump duties. Very bad for everybody. Also for the US. Most idiot policy ever. It makes everything more expensive for everybody and we do not take benefit of the strengths of everyone

Russia can never concer EU even without US support. They cannot even concer their so called vassel state. EU makes Ukrain important, but at what cost? It is destroying all energy intensive industries and accelerating inflation, which will undermine the EU social security system. Investing in more defense will only be good for US defense industry and the sanctions are only good for US LNG export ( 3 times price of Russian gas)